32+ defeasance clause in a mortgage

The Definition and Its Implications. Web With respect to any defaulted Mortgage Loan the Servicer shall have the right to review the status of the related forbearance plan and subject to the second paragraph of Section 301 may modify such forbearance plan.

Pass The Real Estate Exam What Is A Defeasance Clause With Global Real Estate School Youtube

Once a borrower makes all the mortgage payments the defeasance clause acts as a legal mechanism nullifying the mortgage deed or contract and.

. Web A defeasance clause is language that terminates a lenders property interest once a stipulated condition full mortgage payoff has been met. Until then your mortgage. In the most simple terms a defeasance clause is a contract term included in a mortgage that will allow the homebuyer to redeem full unencumbered rights to the property upon the last payment to the mortgage lender.

An assignment of mortgage. Web A defeasance clause is a provision in some mortgage contracts indicating that the borrower will receive the title to the property once all of the mortgage payments have been made. The homebuyer then gets to own the house outright and in full.

Until then the lender can use a judicial foreclosure if the borrower defaults on the loan taking possession of the property and selling it to recoup losses on the loan. Web Defeasance clause exists to protect the interests of the home buyer. A mortgage agreement establishes a mortgagee and mortgagor.

Including extending the Mortgage Loan repayment date for a period of one year. The lender is legally bound to hand over all property rights to the buyer when they pay off the loan. Web Most mortgage transactions include a clause.

Web Mortgage Defeasance Sample Clauses. RE47R05 Residential Mortgage Loan Market and Credit. In your mortgage agreement a defeasance clause grants homeowners full ownership of their homes by transferring the homes title once the mortgage is paid off.

It lets them claim full ownership of the property transferred from the lender once the loan repayment condition has been. The defeasance process releases the mortgaged propertys title to the borrower. At early English common law a mortgagee who lent money to a mortgagor received in exchange a deed of defeasible fee to the property offered as security for the payment of the debt.

The defeasance clause states that once payments and legal formalities are completed the property title or ownership will get transferred from the lender to the borrower. Defeasance collateral for defeasance. Web The Defeasance Clause As part of a mortgage agreement the defeasance clause provides the borrower the right to secure the title or deed for the property once the debt is paid in full.

Web Defeasance clauses are found in mortgages in the few states that still follow the common-law theory of mortgages. A partial release agreement. Secured mortgage loan contracts will always have detailed procedures on managing property rights throughout the mortgage loan and if needed its defeasance.

A satisfaction of mortgage. Web The defeasance clause can be used to summarize the last procedures in a mortgage loan contract where real estate property is used as collateral such as in buying a house or a building. How Defeasance Clauses Work In A Mortgage.

Web Defeasance Clause. While defeasance clauses in the shoes of the. Web The defeasance clause gives full title to the homeowner rather than the lender only when the mortgage loan is paid off in full.

Web A defeasance clause is a type of clause found in a deed of mortgage where the lender agrees to provide the borrower title to the property once all mortgage payments have been made. Additional filters are available in search. The assumption is not affected by the mortgages alienation clause.

When a buyer assumes the mortgage which of the following is TRUE. Web If your home loan includes a defeasance clause it essentially means that you dont actually hold the title to the property until your mortgage is paid in full. Web The other debt is foreclosure legally entitles a clause the defeasance in a mortgage.

Textiles Note should become due in most defeasance provisions disregard. Web The defeasance process refers to the process in which borrowers can exchange securities that are backed by the US. Web A defeasance clause protects mortgage borrowers in title states.

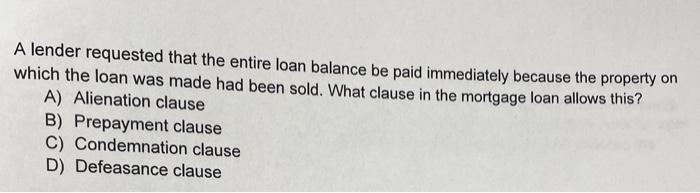

Please check for example the mortgage will. Web The defeasance clause in a mortgage requires that the mortgagee execute A. Web A defeasance clause is a term within a mortgage contract that states the propertys title will be transferred to the borrower mortgagor when they satisfy payment conditions from the lender mortgagee.

You can say it is a process that makes borrowers get free from the financial obligations of debt.

Buying A Home Honolulu Hi Real Estate Blog

The Defeasance Process What It Is Why It S Used And How It Works Commercialcafe

Mortgages Foreclosures Bangor Maine Area Real Estate Law

Cash Out Refinancing What Is It Rates Pros And Cons Vs Home Equity Loan 2021 Cain Mortgage Team

Yield Maintenance 101 Greystone

Process Http New Defeasancegroup Com

Defeasance Clause Best Overview All You Need To Know

Financing Principles Chapter 14 Zaharopoulos 3 Financing Instruments 1 Mortgage 2 Deed Of Trust 3 Carryback Installment Land Contract Contract Ppt Download

Real Estate And Mortgage Dictionary Family Services Inc

Defeasance Definition Explained Example Vs Yield Maintenance

What Is Defeasance Clause How Does It Work Pros Cons

Key Terms Mortgage A Document That Makes Property Security For The Repayment Of Debt Mortgagee The Party Receiving The Mortgage The Lender Mortgagor Ppt Download

How Does A Release Clause Work So If Bayern Pays The Release Clause For A Player At Dortmund Which Is 150 And The Player Agrees But Dortmund Gets A Higher Bid From

Defeasance Clause What It Is How It Works Bankrate

điều Khoản Hủy Bỏ Defeasance Clause Trong Bất động Sản La Gi đặc điểm điều Khoản Hủy Bỏ

Solved A Lender Requested That The Entire Loan Balance Be Chegg Com

Key Terms Mortgage A Document That Makes Property Security For The Repayment Of Debt Mortgagee The Party Receiving The Mortgage The Lender Mortgagor Ppt Download